Car repossessed? How to avoid it and get your car back

We’ve heard the stories of repo men coming and taking away cars once the owners can no longer pay for them. Fret not, certain conditions must be met before the repo men can come to repossess your car. In this article, we will detail the conditions, procedures and your rights during car repossessions and how to avoid it.

How repossession works

The bank doesn’t send repo men to repossess the hirer’s (your) car after you miss a payment. Instead, they must follow the car repossession laws laid out in the Hire-Purchase Act of 1967. Here are the requirements before a repossession can occur:

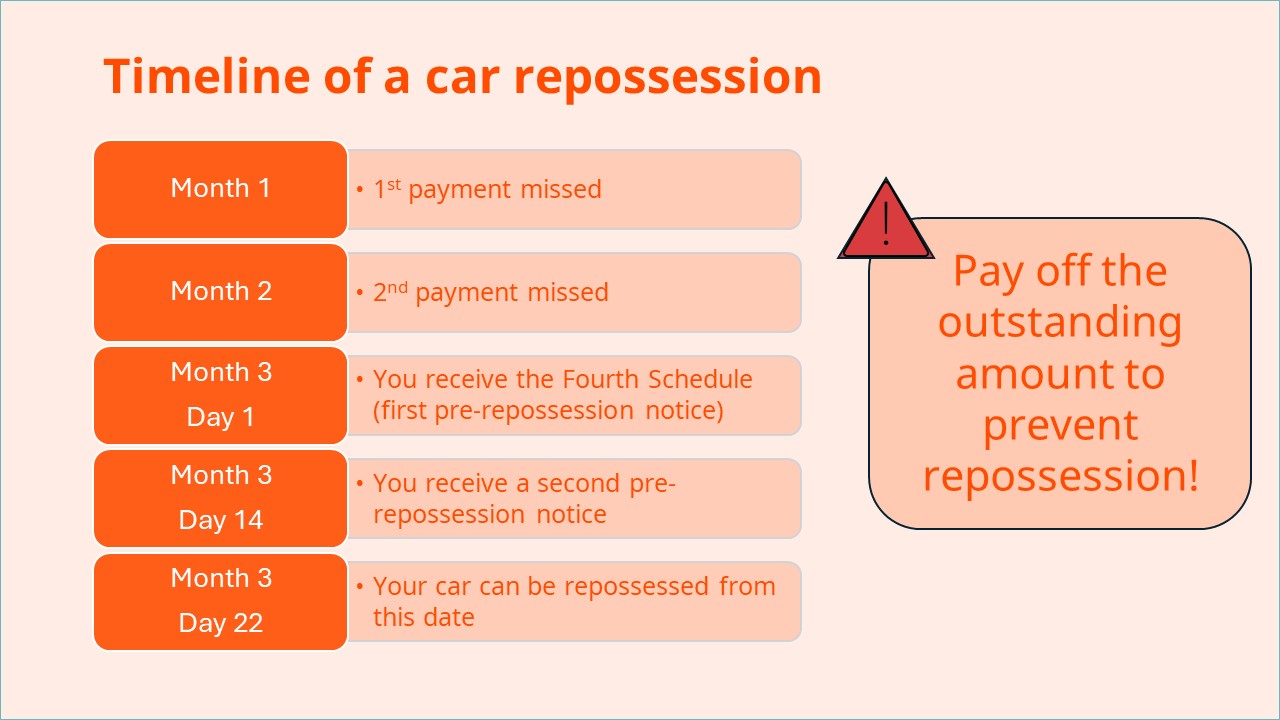

- The hirer has to miss their loan repayments for two consecutive months.

- The Fourth Schedule (pre-repossession notice) has been issued after loan repayments have not been paid for 2 consecutive months.

- A second pre-repossession notice was issued 14 days after the Fourth Schedule was issued.

- A minimum of 21 days has passed after issuing the Fourth Schedule.

The timeline can be seen in the image below:

Your rights during a repossession

While the bank wants to repossess the car, you still have rights. The bank will appoint car repossession agents who must follow procedures and rules during the repossession.

- Repossession agents must not repossess vehicles in gated housing areas.

- Repossession agents must not repossess vehicles on a public holiday.

- Repossession agents can only carry out repossession work from 9 am to 9 pm.

- Repossession agents must also present a repossession order from the financial institution and a court order if the hirer has paid more than 75% of the car loan and has defaulted on their loan twice consecutively.

- Repossession agents must also possess a valid permit issued by the Ministry of Domestic Trade and Consumer Affairs (KPDNHEP).

- Besides, repossession agents must act professionally and dress appropriately when carrying out repossession work.

- Repossession agents are also strictly prohibited from using strong-arm tactics in performing their work.

- Repossession agents must give hirers a reasonable time to inspect their vehicles and remove their items and belongings from the cars before the repossession.

- Repossession agents must also lodge a police report on the repossession immediately to inform them of the validity of the repossession.

- The repossession agents are not to repossess the car by trespassing, using violence, extortion or other illegal means. If the repossession agents act criminally, the hirer has the right to report the incident to the police for legal action against the repossession agents or financial institutions.

You should also take note of:

- The name of the repossession agent.

- The number of the repossession permit.

- The name and address of the bank.

- The location where your car will be stored.

How to get your car back after repossession

Once the car is repossessed, the hirer will be served with the Fifth Schedule within 21 days. You can use this document to get your car back by paying the outstanding loan payments or the outstanding loan in full. You will also have to compensate the bank for:

- The cost of repossession.

- The cost incidental to taking possession.

- The cost of storage.

If you don’t pay the debts specified in the Fifth Schedule within 21 days, the bank has the right to sell your car at an auction or sell it back to you at a lower price than specified in the Fifth Schedule.

Another option is to deliver the car to the bank before the 21 days elapse to avoid paying repossession and storage costs. Of course, you lose the car in the process and your credit score takes a hit.

What if I can’t pay the loan anymore?

No matter how you prepare, there is always the possibility of black swan events that can increase your commitment or decrease your cash flow. The result is stretched finances that can no longer service the car loan. As a hirer, you have two options:

- You can approach the bank to restructure your loan when you realise you can no longer service the loan. The bank may lower your monthly commitment by extending the loan though there is no obligation for the bank to do so.

- Sell the car. If the price of the car does not cover the total cost of the loan, any balance is to be paid by the hirer. It is best to do this ahead of time before you are served a repossession notice.

Read more: Car loans in Malaysia

Repossession is no joke. It not only costs money to get your car back, but it also negatively affects your credit rating. So any loans in the future will be more expensive. To avoid repossession, ensure that your car instalment is not more than 30% of your take-home pay and ensure you have enough emergency funds to weather a storm. Should you receive a repossession notice, know your rights so you can make the best out of the situation.

If you’re looking for a reliable car with affordable monthly instalments, check out Carro! Every car you see is Carro Certified which is thoroughly inspected via our 160-point inspection before being rigorously refurbished to be As Good As New! If you change your mind, you can return the car with our 5-day money back guarantee, no questions asked!