6 reasons buying a used car can save money

Everyone wants something that’s new and unused by others, and this also extends to cars. People love new cars. Breathing in that new car smell, taking the plastic wrapping off your seats, it’s all something we hope to do someday with our own car. But if you can’t afford it, should you buy one? Or should you buy a used car to save money instead?

As cost of living increases, do you really want to spend all that money on a brand new car? If you look around, you might even find used cars that look and feel brand new!

So how does a used car save you money?

Cars Depreciate Quickly

It’s common knowledge that cars are a liability, they are not an investment. Investments are something that make you money. If you are spending money on something, it is not an investment.

Cars lose up to 30% of the value the moment you start driving it, and continue to depreciate rapidly in the first few years. This is why there is a huge price difference between a brand new car and a five-year-old car of the same make and model. Why spend more when you can save?

Lower repayments

Car loans for used cars are generally lower due to depreciation and because the first owner paid for the price of a new car. So you can easily save some money, especially if you take a 5-year loan instead of a 7-year loan. It doesn’t matter if you buy a used Mercedes or a Perodua, both will be cheaper than a new one.

Let us compare four scenarios where you buy a Perodua Myvi 1.5L X for RM49,900, with an interest rate of 3.5%.

A. RM10,000 down payment and paid over 5 years.

B. RM10,000 down payment and paid over 7 years.

C. RM20,000 down payment and paid over 5 years.

D. RM20,000 down payment and paid over 7 years.

| Scenario | A | B | C | D |

|---|---|---|---|---|

| RM10,000 Down Payment | RM20,000 Down Payment | |||

| Payment Period | 5 Years | 7 Years | 5 Years | 7 Years |

| Monthly Repayment | 781.38 | 591.38 | 585.54 | 443.16 |

| Principal | 46,882.50 | 49,675.50 | 35,132.50 | 37,225.50 |

| Interest | 6,982.50 | 9,775.50 | 5,232.50 | 7,325.50 |

| Total | 53,865.00 | 59,451.00 | 40,365.00 | 44,551.00 |

The total difference between scenario A and B is RM5,586, while the difference between scenario C and D is RM4,186. So in both cases, one would need to pay more with the longer loan, but over a longer period. Paying a longer loan may be better for those that want to spread out their costs.

However, the lower your down payment, the more money you end up paying. Note how in scenario A the payment is RM13,500 more than scenario C and in scenario B the payment is RM 14,900 more than scenario D.

In short, the longer your loan and the smaller your down payment, the more you pay back in loans. So you should try to adjust depending on your ability. You can also read our tips on how much you should spend on a new car to learn more which loan repayment type might be for you.

Less money on upkeep

If you ever bought a new car, you know what it’s like to wait at a service centre for your car. New cars have tight and strict service schedules that must be met in order to keep the car at a higher value and to keep the warranty. And if you happen to buy a car that has a lot of defects, you will be spending many a day stuck without a car. These so-called ‘lemons’ are a new car buyer’s nightmare.

Thankfully, if you buy a used car, you can easily avoid all the lemons. If you do your research, pour through maintenance records, and crunch the numbers, you can verify if a car is a lemon or not. Or you could find your dream car with myTukar where we vet and check all our cars, so when you buy from us, such lemons will not be a concern!

Lower Car Insurance

Another thing that makes cars expensive is the insurance. As car insurance is calculated with the car’s market value in mind, your used car with depreciated market value will have cheaper car insurance.

One place to get the right car insurance for you is PolicyStreet.com! You can settle your car insurance and road tax there in just a few easy steps.

Lose Less When You Sell

Eventually, you’re going to sell your used car and save money. And when you do, you will be recouping most of your money when you sell it close to the price you bought it for.

Get More For Less

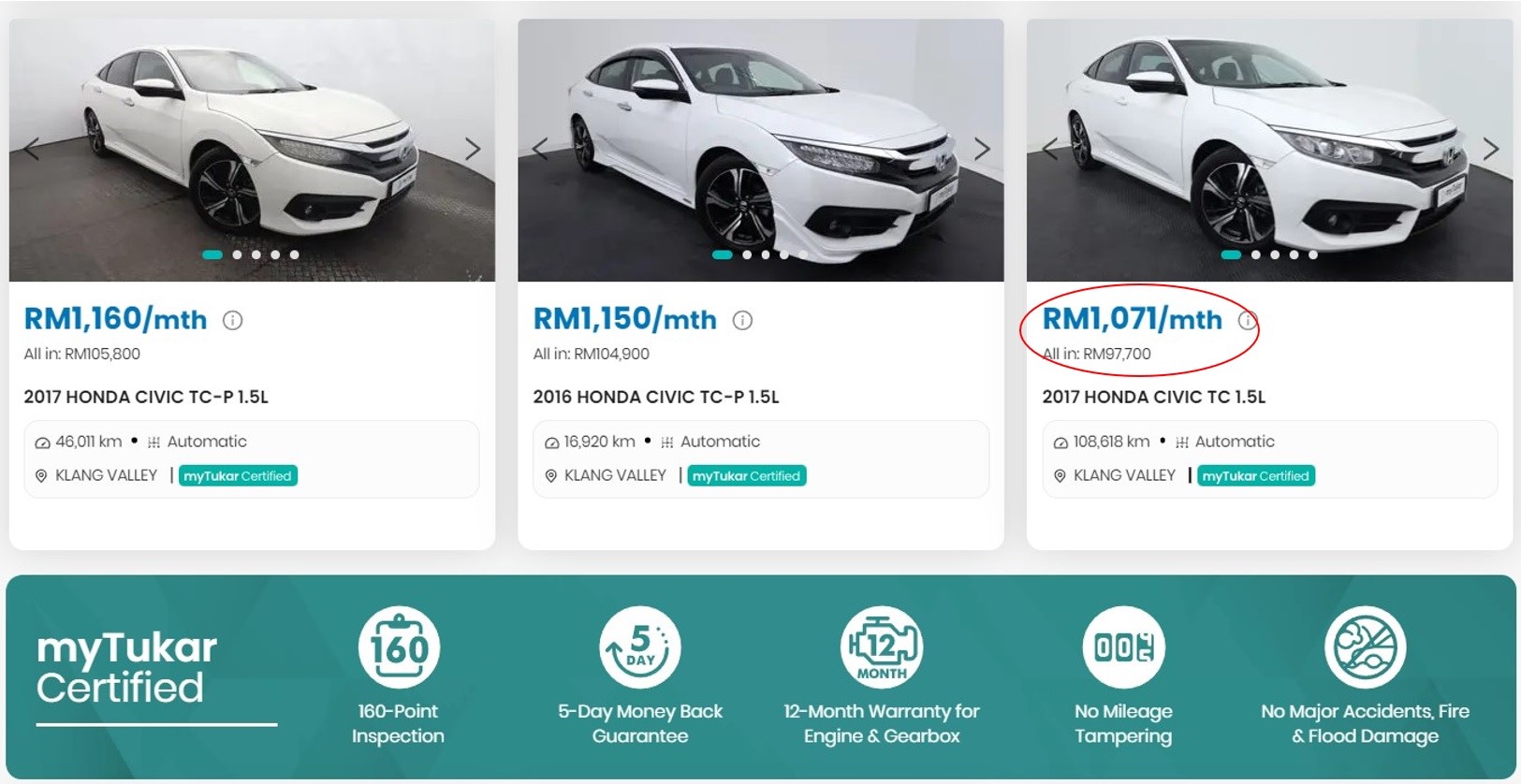

Let’s say your budget is RM100,000. You can own a brand new Toyota Vios (RM98,100 B-Segment). But if you buy a used car, you can buy cars a segment or more higher.

As you can see, you can easily buy a 2017 Honda Civic (C-Segment) for RM97,000.

If you still insist on buying a new car, maybe check out Guaranteed Buy Back Value and learn about how you can resell your car at a guaranteed price! It will save you even more money.