Buy a Carro Certified car and enjoy a special 2.96% interest rate with 24-hour approval!

If you’ve ever taken out a loan, you’ve heard the words credit score. This score is what determines the interest rate on your loans and how much you have to pay the bank. Of course, we want low interest rates when we buy cars but to get there we need good credit scores. In this article, we will go through everything you need to understand and improve your credit score so you can buy the right car for you at low interest rates.

Enjoy a special 2.96% interest rate with 24-hour approval on your car purchase with Carro!

It takes time to build a good credit score, so if you want to get your dream car at good interest rates NOW, you can get a Carro Certified car which is thoroughly inspected per our 160-point inspection and then rigorously refurbished to be As Good As New! From 14 June to 14 Aug 2024, you can get an exclusive interest rate of 2.96% and 24-hour loan approval with Maybank when you buy a car with Carro!

You’ll also enjoy discounts up to RM5,000 off on selected Carro Certified cars, so keep an eye out for those! No matter what car you drive home, you could be one of 300 lucky winners of an extra year of FREE car service with Carro Care!

What is a credit score?

A credit score is essentially a health report. Lenders like banks use this report to determine how risky it is to lend you money. This score ranges from 300 to 850 with 300 being the worst and 850 as the best. So the better the score, the more likely lenders will give you loans, offer lower interest rates and even approve your loans faster. If your score is low, lenders will require more assurances before offering you a loan, including higher interest rates and collaterals. If you do not have a credit score, it would be difficult to get a loan. So how do we get a score?

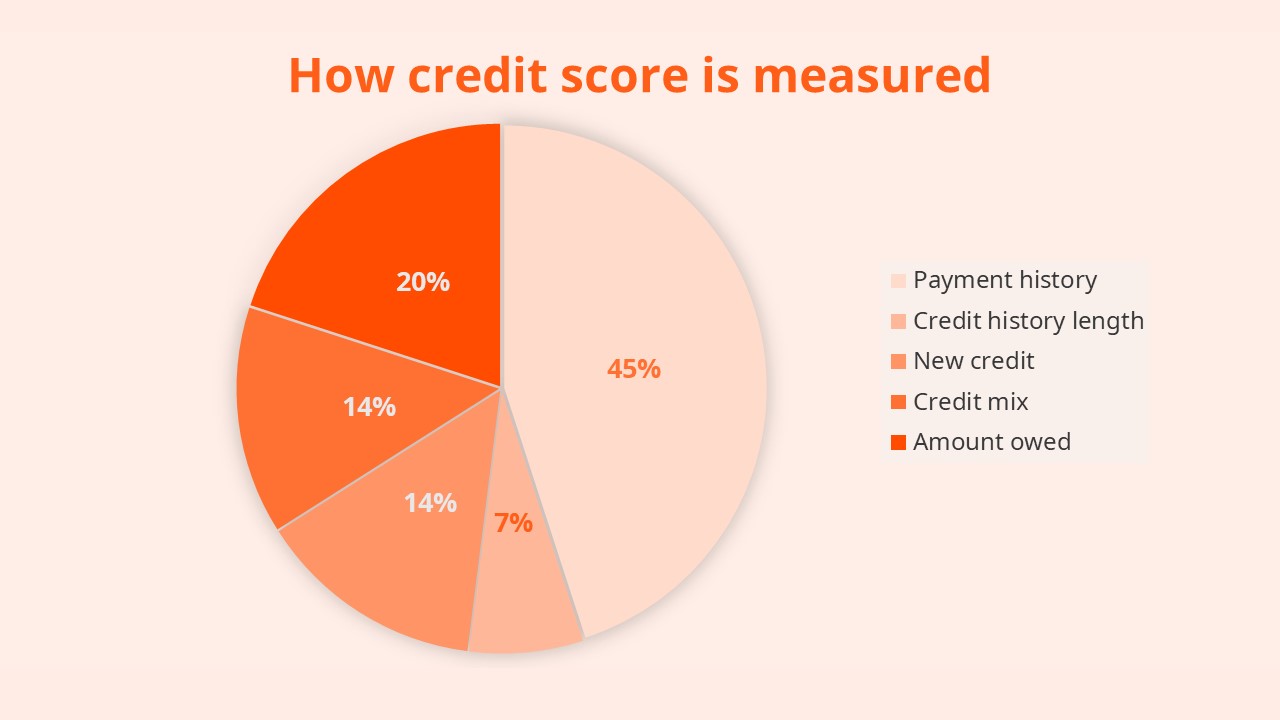

How credit score is measured

To get a credit score, you need to have borrowed money from an institution like a bank. Your score will then be based on these criteria:

- Credit history length: How long you held a credit card or loan

- New credit: This is based on how long you held a credit card or loan

- Credit mix: This is determined by checking your secure loans (housing and car) and unsecured loans (credit cards)

- Amount owed: Having more loans will lower your score

- Payment history: Late payments will negatively affect your score

Other ways to measure your credit score include:

- How much of your available credit you’re using

- New applications for credit

- Whether you have had a debt collector sent your way, a foreclosure, or a bankruptcy, and how long ago it occurred

- Dishonoured cheques

How to figure out your credit score

There are a number of websites that can help you check your credit score. You can contact your bank or visit the websites of Credit Tip-Off Service (CTOS) or Credit Bureau Malaysia. These websites can help you figure out your credit score but often at a small fee. Even so, it is advisable to check once a year to keep track of your credit score.

These websites get their info from the Central Credit Reference Information System (CCRIS), managed by Bank Negara Malaysia. You can go to the website and get the report yourself for a small fee of RM1 which will be refunded in 2 working days! This report will show your credit history from the past 12 months, including car loans, trade facilities, banking overdrafts, late payments and more. It is important to note the CCRIS report does not include a credit score. Lenders use this report to create a credit score and assess how risky of a borrower you are.

How to improve your credit score

Timely repayments

Ever lent money to someone and they took forever to pay it back? Lenders are the same. They like their money back in a timely manner. So make sure you pay back your loans on time or even a little early. If you are overdue by over two months, your credit rating will go down.

Apply with purpose

If you apply for a large number of loans at once, the chances of you getting rejected are higher. When lenders see a large number of rejections, they are more likely to turn your application down. Instead, pick the loan that best matches your financial standing to keep your score good.

Settle small loans first

If you have smaller loans, you can pay these off first. This will reduce your financial obligations and make your financial health better in the eyes of the lenders as fewer obligations mean extra cash to pay off the loan. One thing you can do is sell your car that is either rarely used or costs you an arm and a leg in repayments. This will both reduce your financial obligations and give you some extra cash in hand.

Keep credit utilisation low

If your bank gives you an RM10,000 credit limit, it is good to spend within the RM10,000 limit. It is even better if you use much less than the limit. If you go over the limit, this is what we call an overdraft.

Avoid overdrafts, always

There are several drawbacks to an overdraft. The first is the overdraft fees. It’s basically a fine for going above the limit. Second is that it appears financially irresponsible to lenders, which would either cause interest rates to go up or get your loan rejected.

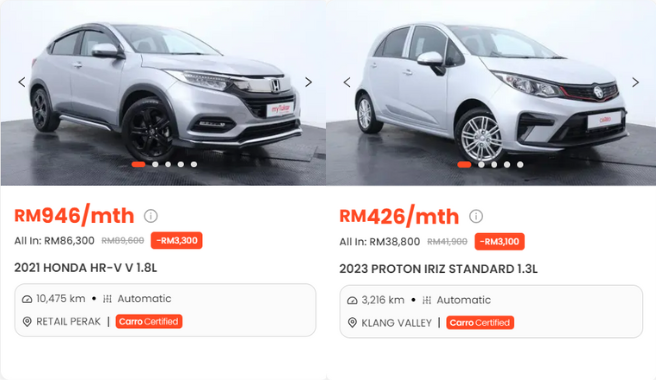

Get yourself a car that is As Good As New

Why not complement low interest with low mileage? You can consider Carro Certified cars like this 2021 Honda HR-V V1.8L which has a low 10,475km clocked-in or this 2023 Proton Iriz Standard 1.3L with just over 3,216km on the odometer.

Find similar Carro Certified cars with mileage from as low as 3,000km.

Don’t forget to keep an eye out for cars with up to RM5,000 off, so you could be walking away with your dream car from as low as RM16,000.

From 14 June to 14 Aug 2024, buy a Carro Certified car from our extensive catalogue and get an exclusive interest rate of 2.96% and 24-hour loan approval with Maybank and stand to be one of 300 lucky winners of an extra year of FREE car service with Carro Care! If you already own a car you want to sell before buying a new one, you can book a FREE inspection here!