Car loan guide: New car vs used car loan in Singapore

Buying a car in Singapore is no small decision, especially with COE prices constantly in flux and loan rules that are stricter than in many other countries. Whether you’re eyeing a brand-new car or a reliable used one, you’ll probably need to take out a car loan.

But here’s where it gets tricky: Not all car loans are the same. New and used car loans come with different terms, rates, and trade-offs. In this guide, we’ll break down the key differences so you can make the smartest decision for your budget and lifestyle.

First, the basics: What is a car loan?

A car loan is a financing plan where a bank or lender covers part of your car’s cost, and you repay it in monthly instalments. In Singapore, most loans are regulated by the Monetary Authority of Singapore (MAS), which sets limits based on the car’s Open Market Value (OMV).

As of now:

- If the OMV is ≤ S$20,000, you can borrow up to 70% of the purchase price.

- If the OMV is > S$20,000, the loan cap is 60%.

- Loan tenure is capped at 7 years.

- Carro’s PHV driver exclusive: Carro is offering extended financing of up to 10 years to PHV drivers in Singapore.

This rule applies to both new and used cars, but the type of car you buy still affects the actual loan conditions.

New car loan: Pros, cons, and what to expect

If you’re buying a brand-new car, your loan terms will typically be:

- Lower interest rates: Usually between 2.28% – 2.78% p.a. (as of 2025).

- Higher loan amounts: Possibly because the car’s condition and value are clear-cut.

- Longer tenures: Up to 7 years, giving you more flexibility in monthly payments.

- Easier approval: Especially if you’re buying from an authorised dealer with bank tie-ups.

| Pros | Cons |

| Lower rates = less interest paid overall | Higher upfront cost (due to COE + registration fees) |

| More reliable car = fewer repair worries | Depreciation hits hardest in the first 3 years |

| Better resale value after loan tenure | – |

Best for: Drivers who want peace of mind, longer-term use, and lower maintenance costs.

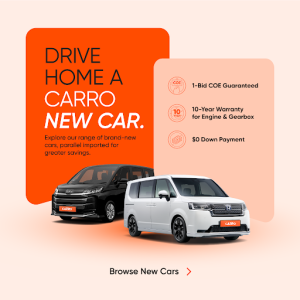

Tip: Buying new through Carro’s New Cars? We offer easy financing with competitive rates and zero hidden fees.

Used car loan: What’s different?

Used car loans follow the same MAS rules, but the details vary depending on the car’s age and condition.

- Higher interest rates: Typically 2.88%–3.5% p.a., depending on the car’s age.

- Shorter loan tenures: Often 5 years or less if the car is older.

- Lower loan quantum: Because the car has depreciated, banks may lend less, or ask for higher down payments.

- Stricter assessments: Lenders may review your credit score more closely.

Pros:

- Lower overall price = smaller loan required

- Good for short-term ownership (e.g. 3–5 years)

- Great if you’re okay with an older COE or used car

Cons:

- Higher interest costs

- Shorter repayment period = higher monthly instalments

- Higher maintenance and repair costs

Best for: Budget-conscious buyers or short-term drivers who don’t want to commit to a brand-new car.

Looking for used cars? Discover Carro Certified used cars at unbeatable value – all backed by Carro’s peace-of-mind promise.

Key comparison: New vs used car loan at a glance

| Feature | New Car Loan | Used Car Loan |

| Interest rate | 2.28% – 2.78% | 2.88% – 3.5% |

| Loan tenure | Up to 7 years | 5–7 years (shorter if older car) |

| Loan amount | Up to 60–70% | Usually lower (depends on car age/condition) |

| Monthly instalments | Lower (longer term) | Higher (shorter term, higher rate) |

| Total interest paid | Lower | Higher |

New vs Used Car: Which Should You Buy?

Choosing between a new or used car isn’t just about the price tag – it’s about your budget, priorities, and how long you plan to keep the car. Each option comes with its own trade-offs, and understanding them can help you make a smarter choice.

| New Car | Used Car | |

| Upfront Cost | Higher – includes full COE, registration fees, and new car premium | Lower – COE may have fewer years left, price already depreciated |

| Loan Options | Longer loan tenure available (up to 7 years) | Shorter loan tenure (depends on remaining COE) |

| Reliability | Maximum reliability – no wear & tear yet | May require more maintenance, depending on age and condition |

| Warranty | Full manufacturer warranty | May have partial or no warranty unless dealer-provided |

| Depreciation | Highest in first 3 years | Slower depreciation curve |

| Features & Tech | Latest safety, fuel efficiency, and infotainment features | May have older tech, though still solid for daily use |

| Resale Value | Higher after loan tenure if well-maintained | Lower, but less impact from depreciation over time |

- Go new if: You want peace of mind, prefer longer loan terms, and don’t mind paying more upfront for a trouble-free ride.

- Go used if: You want to save on purchase price, don’t mind a shorter loan, and are okay with potential repairs or a shorter remaining COE.

Whether you go new or used, both have their pros and cons – and with Carro, you get a trusted, transparent experience either way. We offer both new and quality-assured used cars, so you can choose what fits you best.

Final thoughts: Get the best deal either way

Whether you’re buying new or used, don’t just focus on monthly instalments. Look at the total cost of ownership – loan interest, maintenance, insurance, and eventual resale value all matter.

And most importantly, compare loan options before you sign anything. Some dealerships (like Carro!) offer in-house financing with better rates, faster approvals, and flexible terms that suit your needs. Check out our loan options here.

🚗 Ready to explore your options? Check out Carro New Cars for brand-new vehicles with full loan support and a peace-of-mind warranty.