How to calculate car loan interest in Singapore

Buying a car in Singapore is a big financial decision. Whether you’re getting a new or used car, knowing how to calculate your car loan interest helps you plan your budget and avoid surprises.

Also, check out our car loan guide on new vs used car loans in Singapore.

Here’s a simple breakdown of how it works.

1. Know your loan amount

Your loan amount is the price of the car minus your down payment. In Singapore, MAS regulations cap the loan amount based on the car’s Open Market Value (OMV):

- OMV ≤ $20,000: Up to 70% loan

- OMV > $20,000: Up to 60% loan

Example:

Car price: $100,000

OMV: $25,000 (max 60% loan)

Loan amount = $100,000 × 60% = $60,000

2. Understanding a car loan’s interest rate

Car loans in Singapore typically use a flat interest rate. This means interest is calculated based on the original loan amount, not the reducing balance.

Take for example the Honda S2000 above, priced at $93,888.

Loan amount: $55,000 (example)

Interest rate: 2.5% p.a.

Loan term: 5 years

Total interest = Loan amount × Interest rate × Loan tenure (in years)

Total interest = $55,000 × 2.5% × 5 = $6,875

3. Calculate monthly repayments

Add the total interest to the loan amount, then divide by the number of months.

Total repayment = $55,000 + $6,875 = $61,875

Monthly repayment = $61,875 ÷ 60 = $1,031.25

Flat interest rate vs effective interest rate (EIR)

While car loans are advertised with a flat interest rate, this doesn’t show the true cost of borrowing.

That’s because interest is calculated on the original loan amount for the entire tenure, even though you’re gradually paying it off. The effective interest rate (EIR) takes this into account and is always higher than the flat rate.

Example using the same loan above:

- Loan amount: 55,000

- Flat rate: 2.5% p.a.

- Tenure: 5 years

- Monthly repayment: $1,031.25

If you calculate the EIR based on the reducing loan balance, it works out to roughly 4.6% p.a. – almost double the flat rate.

This is why the EIR is a better measure of your true borrowing cost. Always check with your bank or use a car loan calculator that shows both flat and effective rates before deciding.

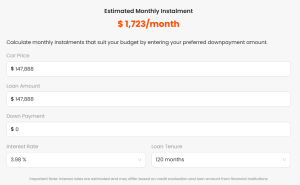

Use a car loan calculator

Instead of crunching numbers manually, you can use a car loan interest calculator to get quick results.

We have a built-in car loan calculator available towards the bottom of our page whenever you’re viewing a car.

Just enter your car price, loan amount, down payment, interest rate, and loan tenure.

When you buy a car with Carro, we can help you compare rates, apply for a loan, and handle paperwork so you can focus on choosing your dream car.

Understand before you commit

Car loans in Singapore may look straightforward, but the way interest is calculated can make a big difference to your total cost. Don’t just focus on the flat interest rate – always check the EIR to understand the real price of borrowing. A few minutes of calculation or using a loan calculator can help you choose a loan that saves you thousands over the years.

With Genie Singapore, you can easily compare loan options, check your affordability, and get transparent breakdowns of both flat and effective interest rates before you commit. Plus, through Carro, you can trade in your car, get it inspected, and finance your next purchase all in one place – making the whole process faster, clearer, and stress-free.